Key Takeaways

- AI Targets Overserved Markets: AI is disrupting businesses that over-serve their customers by offering more than needed. In film and video, AI solutions providing cost-effective alternatives for lower-tier productions like onboarding videos are gaining popularity.

- Cost Reduction in Video Production: AI offers significant cost savings in all stages of video production. Tools like ChatGPT for concept creation, digital avatars, and AI-generated sound effects reduce expenses, making these areas ripe for disruption.

- Strategic AI Adoption: Startups should focus on overserved niche markets with scalable AI solutions. Incumbents must invest in AI to stay competitive by meeting evolving customer needs. Investors should back companies leveraging AI to disrupt traditional production processes and scale effectively.

Strategic Analysis of Disruption in the Film, Video, and Television Industry

Applying Christensen’s Theory of Disruptive Innovation

According to Clay Christensen’s theory of disruptive innovation, detailed in his book The Innovator’s Dilemma, incumbent players in any industry are susceptible to disruption when new entrants offer a product that, while initially inferior, provides distinct benefits to a new cohort of customers. When these new entrants achieve product-market fit and can innovate more quickly than established players, the dynamics for rapid disruption are set. Typically, new entrants target overserved customer groups with scaled-down versions of existing products or services, meeting their needs at a lower cost. Due to their agility and responsiveness to contemporary users, these new players can eventually bring their products to parity with established offerings, fundamentally altering the competitive landscape.

Market Segmentation in Film, Video, and Television

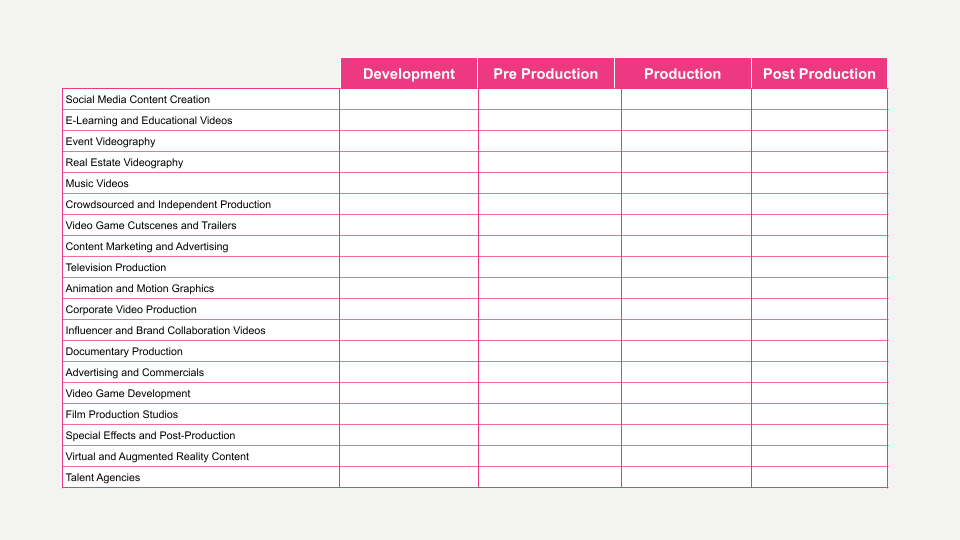

The film, video, and television industry consists of several sectors with varying total addressable markets (TAM). The largest sectors, with TAMs over $100 billion USD, include:

- advertising and commercials

- video game development

- content marketing and advertising

Sectors with TAMs ranging from $10 to $100 billion USD include:

- film production studios

- special effects and post-production

- virtual and augmented reality content

- talent agencies

- television production

- animation and motion graphics

- corporate video production

- influencer and brand collaboration videos

- social media content creation

- e-learning and educational videos

- event videography

Smaller sectors, with TAMs under $10 billion USD, include:

- documentary production

- real estate videography

- music videos

- crowdsourced and independent production

- video game cutscenes and trailers

Predictions for 2024

Industries that control big dollars will obviously become the most attractive targets for disruption as innovators attempt to reinvent them. However, the financial scale of any business is not the thing that drives early disruption.

The businesses impacted by the first wave of disruption are those that over-serve their customers, providing more than what is necessary. In the film and video industry, this can be seen in terms of production values. For example, a Super Bowl commercial requires high production quality, but an onboarding video for new employees does not need the same level of polish. If an AI solution can offer companies cheaper onboarding videos that are almost as good as (or potentially better than) what they currently produce, it is likely that the new technology would be adopted. Today, many AI video solutions target this market. Companies like Synthesia and Veed.io are prime examples of this trend.

Generally speaking, high production values are critical in sectors such as advertising and commercials, video game development, film production studios, special effects and post-production, virtual and augmented reality content, and talent agencies. These sectors demand top-tier production quality, making them ripe targets in the long run but for now AI still has a way to go before these industries are radically disrupted.

Before that happens it is likely that areas that demand lower production values will be more susceptible to scaled down tools that are good enough but a fraction of the cost. Industries that are more likely to see disruption in the near future could include:

- content marketing and advertising for SMBs

- television production on more formulaic, lower quality shows

- animation and motion graphics on the low end of the market

- corporate video production

- micro influencer and brand collaboration videos

- documentary production

- social media content creation particularly for SMBs

- e-learning and educational videos

- event videography

- real estate videography

- music videos for emerging artists

- crowdsourced and independent production

- video game cutscenes and trailers

DISRUPTING THE CREATIVE PROCESS

Producing video, whether it’s a virtual tour for a real estate company or a television commercial, involves a four-stage process that consumes varying amounts of capital. During Development, the first stage, financing can be expensive. Once in Pre-Production, set design requires considerable investment. The major expenses in Production are filming and special effects, while Post-Production costs are driven by editing and visual effects (VFX).

AI technologies offer alternative solutions to reduce these costs. For example, AI-driven tools like ChatGPT can facilitate brainstorming and concept creation. Digital avatars provide a cost-effective alternative to live actors, and AI audio tools can generate music and sound effects, significantly lowering production expenses. Because these components represent opportunities for such high potential cost savings, they will be prime areas for disruption once the technology is able to deliver.

Other Considerations & Notes

There are many other things that could be factored into this analysis including:

Competitive Landscape Analysis

A thorough analysis of the competitive landscape within each sector can reveal vulnerabilities among incumbents. Understanding the strengths and weaknesses of current market leaders helps identify specific entry points for new entrants. For instance, smaller sectors with lower production values and less entrenched incumbents may offer more accessible opportunities for disruption.

Technological Readiness and Adoption

Assessing the readiness and adoption rates of AI and other emerging technologies within each sector provides a realistic view of their disruption potential. Factors such as technological maturity, regulatory challenges, and market receptivity must be considered. Sectors with higher technological adoption rates and fewer regulatory hurdles are more likely to experience rapid disruption.

Impact on Jobs and Skills

The introduction of AI in the film, video, and television industry will inevitably impact jobs and required skills. Addressing how the workforce might need to adapt and identifying opportunities for reskilling or upskilling are crucial for stakeholders. As AI takes over routine and repetitive tasks, creative professionals can focus on more complex and innovative aspects of production.

Financial Analysis

Incorporating a financial analysis to estimate cost savings and return on investment (ROI) from implementing AI technologies strengthens the argument for disruption. Projections of cost reductions, efficiency gains, and potential revenue growth can provide a compelling case for stakeholders to embrace AI-driven innovations.

Preliminary Recommendations for Innovators

For startups, focusing on niche markets where incumbents are over served and introducing scaled-down, cost-effective solutions is a viable strategy. Leveraging AI to innovate rapidly and capture market share can lead to significant competitive advantages. Incumbents should invest in AI and emerging technologies to stay competitive. Identifying overserved segments and adjusting product offerings to meet the evolving needs of contemporary users can help maintain market relevance. Investors should seek out companies leveraging AI to disrupt traditional production processes, with a clear path to scaling their innovations.